Conveyancing is the legal process of transferring real estate from one party to another.

Buying or selling a home is often described as one of the most important transactions of your life. From a legal standpoint, there are many specific steps to go through, and it can be easy to get lost in the details.

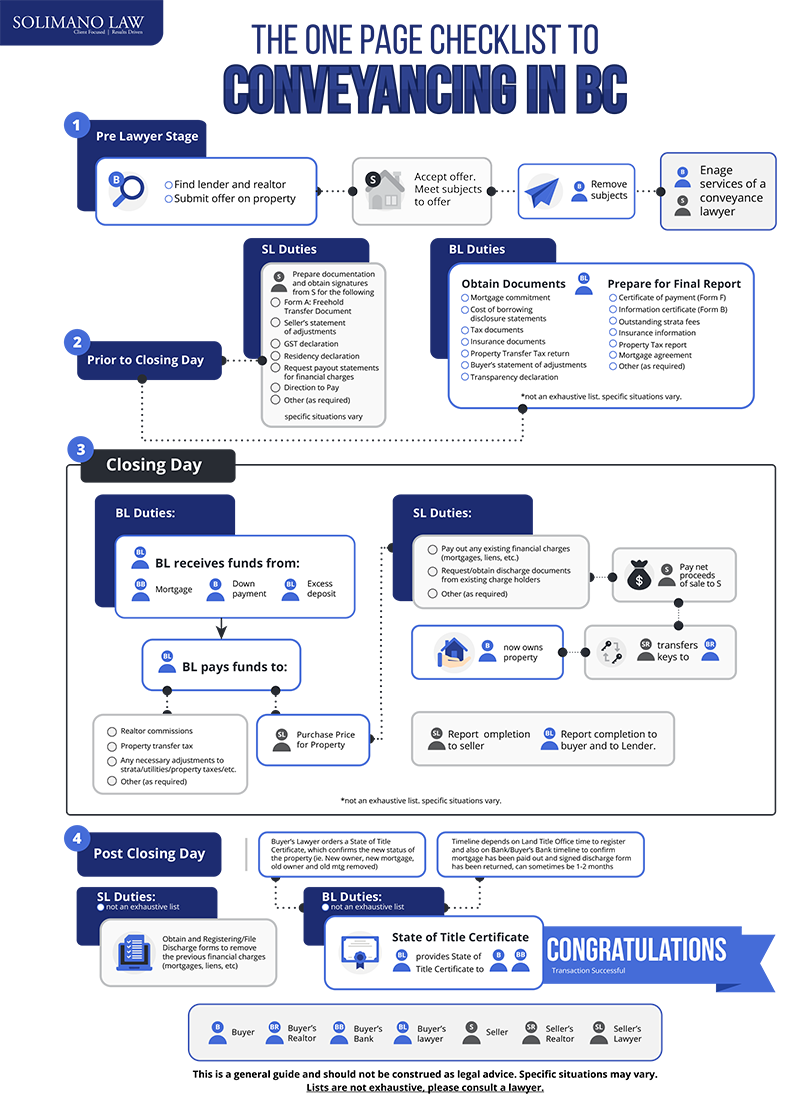

This article aims to provide a step-by-step guide on how this process works in BC, so you know what to expect when buying or selling your home.

Step 1: Beginning the Purchase Process

Generally, the first step is to consult a mortgage broker or lending institution (to help you obtain a mortgage) and a real estate agent (to help you find your property).

Approaching a mortgage broker may best assist in determining how much borrowing power you have. In other words, how much a lender will be willing to loan you to purchase a property.

While you can approach a lending institution (such as a bank) directly, a mortgage broker has access to various lenders and can negotiate a mortgage best suited to your financial circumstances. Conversely, a bank will only be able to offer you their own financial products.

Your realtor will assist in helping you find your property. Generally, realtors have extensive knowledge of the property market. A good realtor will not only help you find a property, but also one that has capital growth potential. They will also handle all the interactions with the seller’s realtor and negotiate a favourable price for you.

Once you have decided on the property, your realtor will prepare an offer (known as a contract of purchase and sale) to send to the seller’s realtor, which sets out the price and conditions of your offer. Generally, at this stage, you would have pre-approval for a mortgage from your mortgage broker or lending institution.

If your offer is accepted by the seller and any subjects to the offer are removed, the realtors and lending institution will send the offer to each party’s respective conveyancing lawyer, who will then begin the conveyancing process.

Step 2: Conveyancing Due Diligence

The conveyancing due diligence process involves a review of all the information involved with the property transfer.

The purpose of this due diligence process is to identify any challenges that may hinder the transaction from being finalized. In doing so, conveyancers review the following:

- the property’s title to ensure that there are no financial impediments that need to be discharged,

- the relevant tax history to verify that there is no property tax in arrears, and

- whether there are any outstanding strata fees associated with the property.

During the due diligence stage, the conveyancers will also order building insurance and title insurance (if required by the lender’s mortgage terms and conditions).

To download this as a printable PDF, click here

Step 3: Document Preparation

Both the buyer’s and seller’s conveyancers prepare documents for the conveyance:

Buyer’s Documentation Preparation and Signing Appointment

When it comes to the documentation that the buyer (or borrower) needs to sign, the following documents are typically involved:

- the mortgage commitment;

- the cost of borrowing disclosure statements;

- tax documents;

- insurance documents;

- the Form B Mortgage document;

- the property transfer tax return; and

- the buyer’s statement of adjustments.

Many of these documents are legally complex. So, before the buyer signs each document, the conveyancer must explain what each document is, and what effect it has on the property transaction.

During the signing appointment, the buyer must confirm that they have sufficient funds to complete the transaction. To do this, they will need to bring a bank draft to cover the remainder of the down payment for the property.

Seller’s Documentation Preparation

When it comes to the documentation that the seller needs to sign, the following documents are typically involved:

- the Form A Freehold Transfer document which effects the transfer of the property to the buyer;

- the seller’s statement of adjustments;

- the GST certificate; and

- residency declaration.

Other documents may be included. For example, if the property is an apartment, the seller may have to sign a parking stall or storage locker assignment form, which assigns the rights to use the parking stall or locker to the buyer.

Once all the documents are signed, the seller’s conveyancer will return the signed documents to the buyer’s conveyancer, who will sign an undertaking that indicates that the documents will not be registered until after the purchase price has been paid.

Step 4: Final Report

The conveyancer will draft a final report to review that all the documents are in order so that they can be filed.

The final report contains the:

- certificate of payment (Form F);

- information certificate (Form B);

- any outstanding strata fees that the seller must pay;

- insurance information;

- property tax report; and

- mortgage agreement.

Step 5: Document Filing

Once the final report has been completed and all the documents have been reviewed for accuracy, the conveyancer will file the following documents to register the transfer of title to the property:

- Form A – Application to Transfer Ownership of the Property,

- Form F – Certificate of Payment,

- Form B – Mortgage, and

- the Property Transfer Tax Return.

Step 6: Mortgage Discharge, Funds Transfer and Keys Exchange

The purchaser’s conveyancer will transfer the purchase funds to the seller’s conveyancer, who will pay out the remaining mortgage, any unpaid strata fees, property taxes and other outstanding amounts. Once the documents have been filed and the title registered, the seller will receive the remaining sale proceeds.

The conveyancer will inform the realtor, who will organize the exchange of keys. Once the keys are exchanged, the buyer takes possession of the property.

Step 7: Mortgage Discharge and Completion of the Conveyancing Process

Once the seller’s conveyancer receives confirmation that the seller’s mortgage has been paid out, they will prepare a Form C, which is the form that discharges the seller’s mortgage. The seller’s lender will sign the Form C and return it to the seller’s conveyancer, who will register the Form C to remove the mortgage from title.

After Form C has been registered, the conveyancer can order the State of Title Certificate, which is a document signed by the Registrar of the Land Title Office. The State of Title Certificate acts as proof that the buyer is now the registered owner.

Once the State of Title Certificate is obtained, the conveyancing process is complete.

Conclusion

In British Columbia, the conveyancing process is complicated. If you are looking for help with any aspects of this process, or have any questions, our team at Solimano Law is available to assist. Contact us today.

Disclaimer – The information contained herein is of a general nature. It is not intended to be legal advice and it is not intended to address the exact circumstances of any particular individual or entity. No one should rely on or act upon such information without receiving appropriate professional advice and without a thorough examination of their particular situation. Please contact our office if you have any questions with respect to the content of this entry, this website, or our Terms and Conditions .